Scaling Growth for Reg-A Crowdfunding Office

Streitwise is a Reg A+ real estate crowdfunding service specializing in commercial (office) real estate investing, open to investors of all wealth levels since 2017 with over $42 million of retail and institutional capital raised.

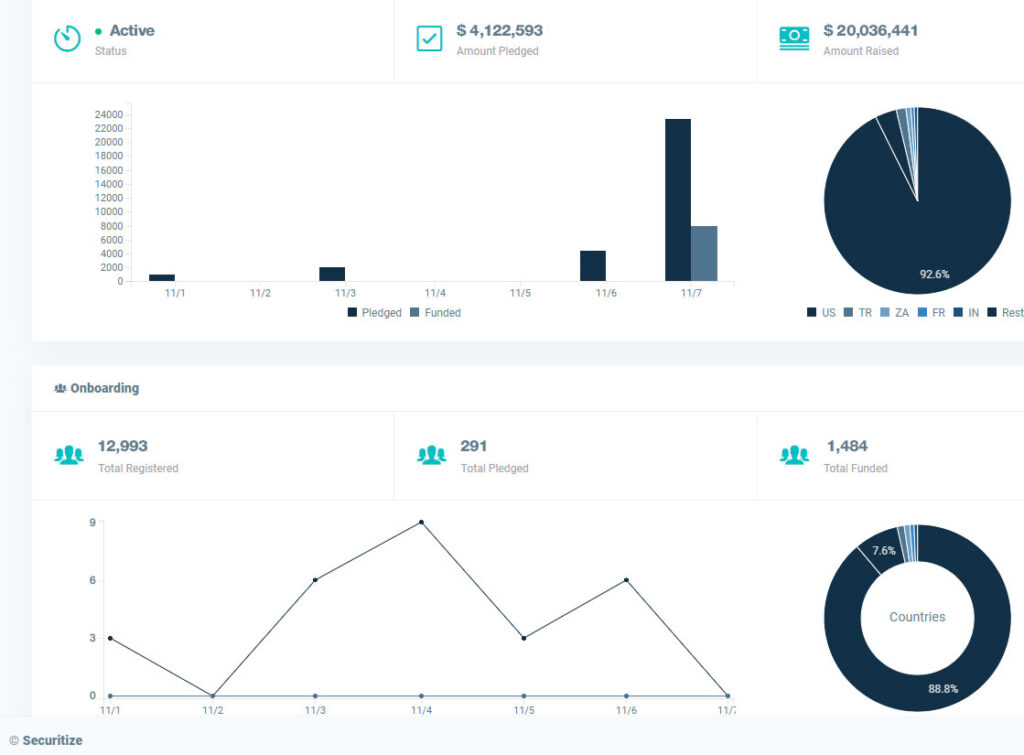

| Entity | Raised |

| Total Investments | $42M+ |

| Total Retail Investments | $28M+ w/ 6 consecutive growth years |

| Reg-A Office REIT Investments | $20M+ ($6M in 2022) |

| Reg-D 506(b) Investments | $4.1M (1 multifamily offering) |

| Reg-D 506(c) Investments | $3.9M (1 multifamily offering) |

Growing a Real Estate Crowdfunding Brand from Scratch to Raise Millions

When I joined Streitwise, the company’s REIT was struggling. Despite managing a promising office REIT, Tryperion had only a handful of investors, mostly family friends, and their marketing agency had generated few leads and even fewer investments. With previous success taking Bitcoin IRA to market, managing the lead generation strategy for a department that would eventually bring over $90 million in investments and success growing the real estate agency GTMA to over 300 clients, I was brought in to turn things around.

I quickly overhauled Streitwise’s branding, partnering with Saatchi & Saatchi for a new logo and rebranding from “stREITwise” to “Streitwise.” I redesigned the website to focus on lead generation and enhanced the user experience to capture sign-ups and a new investor portal to help users track their investments. I worked with the C-Suite and regulatory bodies to add the ability to auto-invest and reinvest dividend earnings and enhance the sign-up process.

Once the lead funnel and customer lifecycle was generated, , I formed key partnerships with financial influencers (such as the Motley Fool), enacted a heavy paid media / SEM campaign to grow the brand.

To continue to leverage growth into the post-Covid office era, I worked with the C-Suite to expand our product offerings using Reg A+ and 506(b) / 506(c) syndications, to allow investors to invest in multifamily offerings. We raised $8 million in 2022-23 from this separate product alone.

By 2022, we raised over $20 million from 1,500+ retail investors, with $6 million raised that year alone, all on a minimal marketing budget. Over $5 million from managed partnerships.

Through strategic marketing, fundraising optimization, and a clear focus on investor experience, I helped transform Streitwise into one of the largest real estate crowdfunding services in the industry.

– Alex Wills, Grow Your Fintech

Capital-Raising Success

Fundraised over $20m for office REIT

At Streitwise, I led marketing and fundraising efforts for the Office REIT, raising over $20 million from 1,500+ retail investors with five consecutive growth years (over $6 million in 2022) and raising $8M from separate syndicated offerings in 2022-2023.

Investor Growth Even During Covid-19 Office Crunch

Expansion in Recessionary Period

| ROAS (Return on Ad Spend) – 2022 | 12.83 |

| Auto-Investment Enrollment | +22% |

| Initial Investments | +58% ($4.5k in 2020 to $7.2k in 2021) |

| Redemption Requests – Post-Covid | ~12% of total shareholders in 2020-23 |

Partnership Program Wins

Streitwise Affiliate / Partnerships

Created an affiliate / partnership program with 200+ partnerships including BusinessInsider, Forbes, and MotleyFool. This review linked is for The MotleyFool’s review. This affiliate program generated over $4.5m in investments for the REIT since 2018.

| Affiliate Program Investments – 2018-Present | $4.5m among 349 new investors |

| Media Partnerships Total | 200+ |

| Premier Media Partnerships | BusinessInsider, Forbes, and MotleyFool |

Landing Page & Website CRO

Website SEO / Development

Enhanced traffic acquisition through SEM/SEO strategies, including content marketing, on-site/off-site link building, and paid search campaigns, which improved lead generation and conversion rates. Redesigned websites to appeal to both institutional and retail investors.

| Conversion Rate | +32% |

| Organic Traffic | +58% |

| Direct Traffic | +40% |

| Branded Search Traffic | +105% |

| Earned Media | +45% |

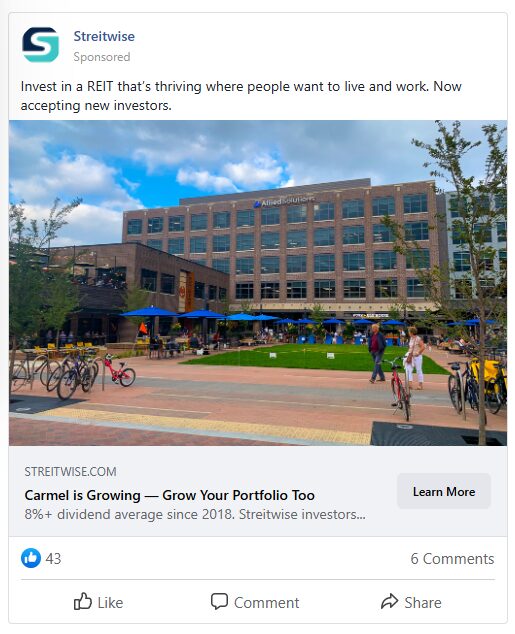

Paid Media

Meta Ads Push

I managed Meta ad campaigns to drive consistent fundraising across Streitwise’s real estate offerings. I structured campaigns around investor intent, retargeting funnel drop-offs, and geo-based interest groups aligned with our property portfolio. By segmenting audiences into new prospects, mid-funnel researchers, and return users, I optimized the ad creative and messaging for each stage of the investor journey. Lead forms were synced to CRM automation, and budget pacing was adjusted dynamically to align with NAV performance updates and dividend yield milestones.

In July 2022, I led Streitwise’s most successful Meta advertising campaign to date, generating $418,000 in new investor capital. I executed a creative refresh emphasizing dividend yield growth and NAV appreciation, paired with Advantage+ placements and custom audiences built from CRM activity. I closely monitored CPL and CAC trends in real time, refining interest targeting around passive income, REIT alternatives, and private real estate investing. I used both gated lead forms and conversion-optimized landing pages, then routed leads into a nurturing sequence for conversion to funded investors.

Paid Media

Paid Media Push

Managed Google Ads as part of a long-term demand gen strategy for Streitwise’s REIT offering. Campaigns focused on capturing high-intent traffic from keywords like “passive real estate investing,” “REIT with monthly income,” and “dividend-producing real estate.” I structured branded and non-branded campaigns separately, used Responsive Search Ads with dynamic sitelinks, and paired search with GDN retargeting. Conversions were tracked all the way through funded accounts using CRM integrations. Google Ads drove the strongest bottom-funnel conversion intent.

| Network | Total Spend |

| Google Search | $768,750 |

| Meta Ads | $1,167,000 |

| Microsoft Ads (Bing) | $338,250 |

| Google Display Network | $246,000 |

| YouTube | ~$185,000 |

| Native (Taboola, Yahoo) | ~$185,000 |

| Programmatic (The Trade Desk) | ~$185,000 |

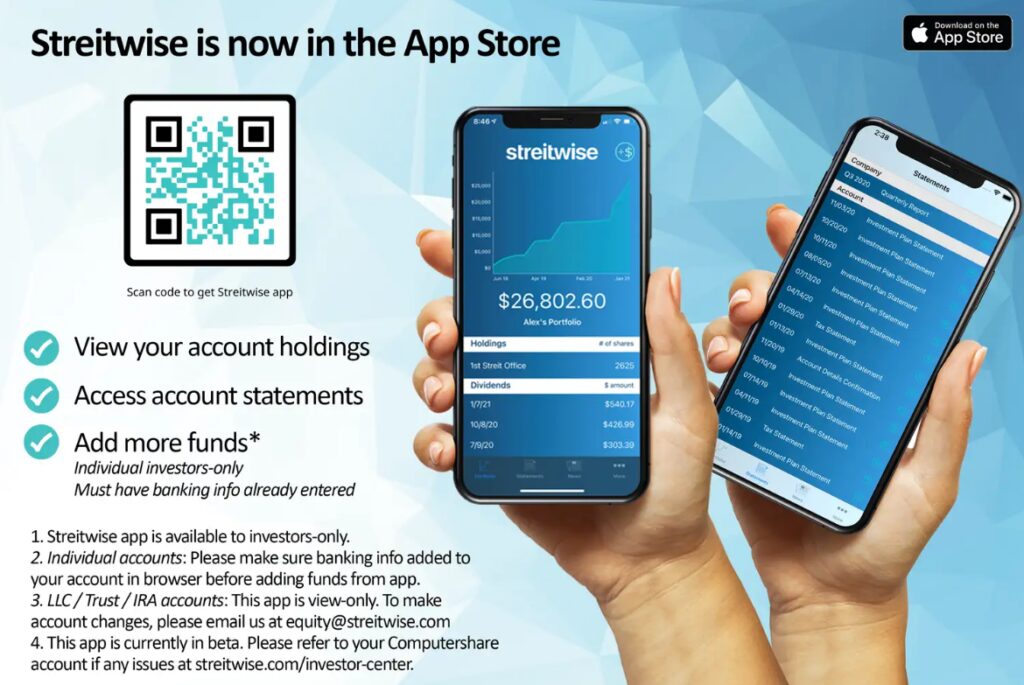

Investor Dashboards

Streitwise Official iOS App

Oversaw the integration of a modern investor portal with a new iOS app for Streitwise investors.

Automated CRM Solutions

Investor Deck / Annual Meetings

In order to qualify as a Reg A+ REIT, the SEC requires at least 50% of shareholders to vote before each annual meeting. I spearheaded both the annual meeting webinar content, presentation script in collaboration with the board, and the shareholder voter outreach strategy. Since 2018, we have successfully met shareholder quorum each year.

Brand Awareness Campaigns

Direct Mailers

Strategic fundraising outreach to areas where our office real estate assets are to acquire new investors using both geotargeting and demographic targeting with a dedicated lead funnel.

Expansion to Syndication Offerings

Streitwise Rebrand

Led the rebranding of “stREITwise” to “Streitwise,” and product shift from sole REIT into multi-offering syndication marketplace.

Influencer Partnership Expansion

Financial Influencers

Example of financial influencers. This is an example live reel interview set up with the Streitwise CEO, from @financialprofessional, an account with over 700k followers.

Client Feedback and Reviews

Alex led our marketing and fundraising initiatives, raising over $20 million from over 1,500 retail investors with the lead funnels to sales pipeline that he created. Alex spearheaded the creation of several separate syndication offerings, helping raise $7.8 million.

His work includes strategic collaboration with the executive team on key decisions such as setting minimum investment thresholds and ensuring SEC compliance in the marketing campaigns.

His approach extends to the digital transformation of our investor portal, transitioning to a new platform with enhanced features that significantly improved the investor experience with both a Streitwise iOS app and a new transfer agent service.

Alex [also] launched a successful affiliate program that got Streitwise valuable press with multiple large-scale financial publications, garnering further brand awareness. In addition, Alex’s SEM strategies, content marketing, and paid campaigns resulted in a substantial increase in organic traffic, while his website redesigns and lead funnels formed the backbone of our marketing operations.

Jeffrey Karsh

Co-Founder & CEO, Streitwise

Streitwise was launched in 2017 and saw significant growth from 2018 through mid-2022, with a capital raise of $20.8 million which was a direct result of Alex launching an affiliate program, engaging with our existing shareholder base through periodic email communications to drive subsequent share purchases, and coordinating targeted marketing efforts with third parties, SEM / paid media efforts, and lead funnels.

Alex was responsible for handling all of the website functionality and updates, tracking relevant data metrics for internal reporting, and maintaining the CRM system for communicating with our shareholders. These duties involved working with third-party vendors across multiple platforms to ensure that they synced together and he handled all troubleshooting.

In 2021 he worked directly with a developer to launch the mobile app for Streitwise so investors had easier access to their investment information.

Janet Pudelko

CFO, Streitwise